|

Why is the value of the American dollar decreasing?

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” - John Maynard Keynes

The short answer is, the dollar continues to devalue as a result of the continual printing of currency. A side effect of this is inflation (the continual increase in prices for goods and services) wikipedia.org.

It is important to note the difference between currency and money.

What currency and money have in common is that they are both:

... Medium of exchange

... Unit of account

... Portable

... Durable

... Divisible

... Fungible (interchangeable)

What money is (that currency is not):

... Money is a store of value, Currency is not.

'Gold and silver are money. Everything else is credit.' J.P. Morgan

Prior to 1971, the US dollar was backed by gold (real money). This was known as the 'gold standard'. Meaning you could exchange a $20 bill for $20 worth of gold. This also meant that the currency supply was tied to the gold supply. Because there was a limited amount of gold, there was a limited amount of currency in the system. This made currency valuable, because it was backed by real tangible value.

Outlined below is an example of a US $5 bill that you were able to exchange at a bank for $5 worth of silver (note the small writing under 'Five Dollars'):

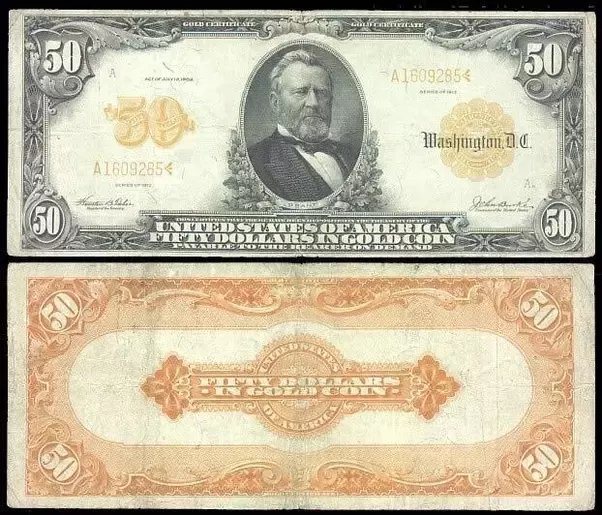

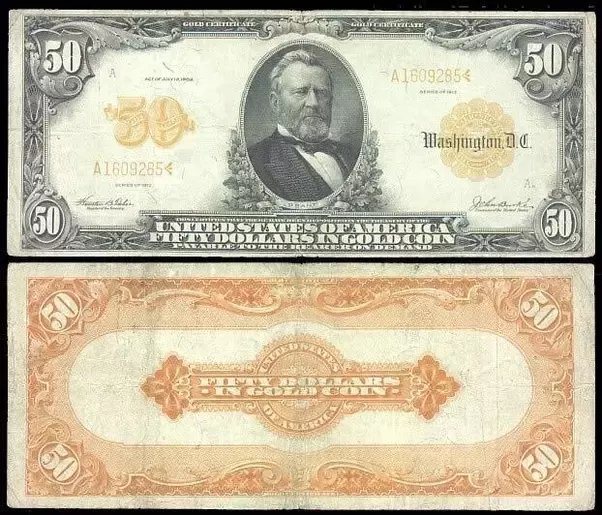

Outlined below, was an example of a US $50 bill that you could exchange at a bank for $50 worth of gold (note the writing after 'United States of America')

In 1971, Richard Nixon severed the US dollar from the 'gold standard' meaning that you could not longer exchange your bills for gold and silver.

Given there was no link between the currency in supply to the gold in supply, the US dollar became a 'fiat currency' meaning, its value was now based on faith, rather than any tangible value.

With no connection to gold, the government can now continue to print unlimited amounts of currency. And they do, vast amounts of currency.

The below graphs show the impact of the purchasing power of the US dollar bill after being removed from the gold standard in 1971. Note how it starts at 100 points and redeuces to under 20 points in a 36 year period.

This graph shows two (2) interesting things:

As the currency in circulation rises (the red line) the purchasing power declines, meaning that it costs you more to buy the same things you did before (inflation); and

There has been an 80% drop in purchasing power of the US dollar bill between 1971 to 2006 (just before the GFC (Global Financial Crisis) hit late in 2007).

This next graph shows the currency in supply as a result of the Global Financial Crisis, the notorious 'bank bailouts' (where the government bailed out the banks that were too big to fail) and 'quantitive easing', which, in simple terms is printing more currency (usually to cover more debts):

If the US dollar had lost 80% of it's purchasing power by 2006, what do you think its purchasing power is today as a result of 'quantitive easing' and bank bailouts?

In essence, the US government is printing currency to cover their debts. But don't worry, so are other countries.

(TPB Note: This is a bad conclusion. It is perhaps convenient to blame the 'government' for this problem, but it is a systemic problem with the private banking system, the central banks and the government all implicated in the dysfunction.)

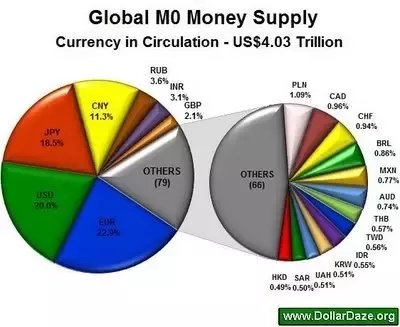

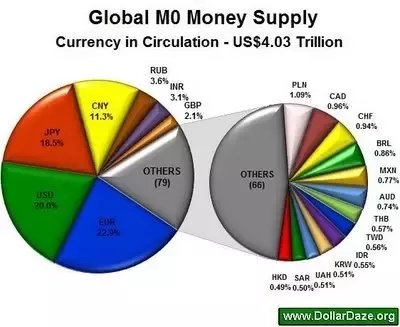

This next graph shows the amount of currency in the world (source: http://dollardaze.org )

The reason why it is not so obvious when we compare the US dollar to other currencies (Japanese Yen, the Euro and Chinese Yuan Renminbi) based on the exchange rates is that they too are printing 'fiat currency' just as the US government is. So fiat currencies are being measured against themselves. In effect, peices of paper are being measured against other peices of paper.

This below graph also shows the other major currencies in response to the Global Financial Crisis. Notice the rapid expansion of currencies across the board?

To date, the total US debt is approaching $18 Trillion dollars (nationaldebtclocks.org)

What does that look like visually? Here is an example of $15 Trillion (stacks of $100 bills) which was the level reached by 2011:

(TPB Note: It is wrong to conflate the problem of Government Debt with the issue of monetary system dysfunction. They are separate problems which need separate solutions.)

In the immortal words of George Washington in his letter to James Welsh in 1799:

'To contract new debts is not the way to pay old ones.' George Washington

The increase of currency supply to an economy causes a devaluation of the currency and more important, a rise in the prices of goods and services.

The way to measure the devaluation of the US dollar is to watch the fluctuation of the gold price. Notice any correlation between the amount of currency in circulation and the gold price?

Two (2) websites worth researching into on this topic are:

GoldSilver.com (http://hiddensecretsofmoney.com) ; and DollarDaze.org (http://dollardaze.org).

According to Mike Maloney at Goldsilver.com:

'all fiat currencies return to zero.' Mike Maloney

This means that the US dollar, like all fiat currencies gone before it, will eventually lose its entire value. The question is: when?

'There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.'

- Ludwig von Mises

What is China doing?

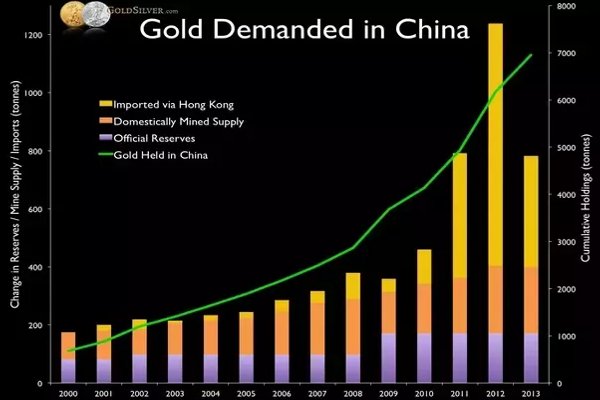

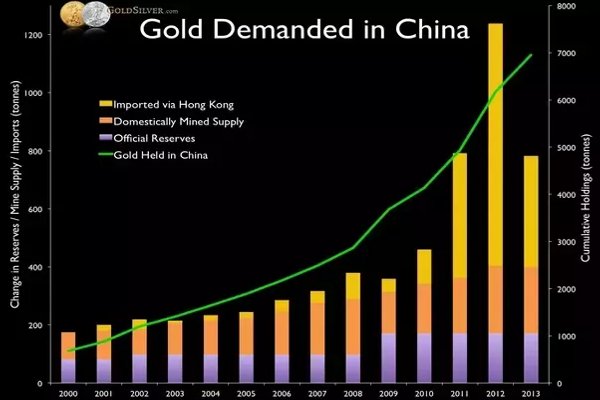

China is buying gold. There is significant demand by the Chinese for gold. The graph below supports this position. Notice the correlation between the rise in demand for gold by China and the increase of US dollar currency supply in the previous graph?

This may very well mean that China is anticipating a collapse of the US dollar and is making moves to prepare for such a collapse. China is effectively sending back the US government's fiat currency and exchanging that for gold (real money).

|