|

Go to the profile of Alexander Lange

Alexander LangeFollow

VC @EarlybirdVC | Ex BusDev | Crypto enthusiast | #blockchain #web3.0 #decentralization #P2P #cryptotrading #legaltech #VC #democratization

Jun 1

Mapping the decentralized world of tomorrow

The Media is going crazy about Bitcoin, Ethereum and the rise of crypto markets. Entrepreneurs from the sector have kind of a Rockstar status raising millions of USD in seconds through ICOs. However, the crypto sector is much more than Bitcoin, fintech, trading and crypto currencies — it’s about building a better, decentralized, (digital) world.

By using the term “decentralization” I refer to a process of redistributing functions, people, powers or things away from a central authority. The problem with centralized systems is that they lack transparency, allow for single points of failure, censorship, abuse of power and inefficiencies. The fundament of their existence often is missing trust within communities or networks, so they need a trust building intermediary to be organized. Paradigm shifts towards decentralized systems are enabled by new technological breakthroughs (i.e. blockchain, cryptography, consensus mechanisms), a rapidly growing developer community as well as new ways of raising capital.

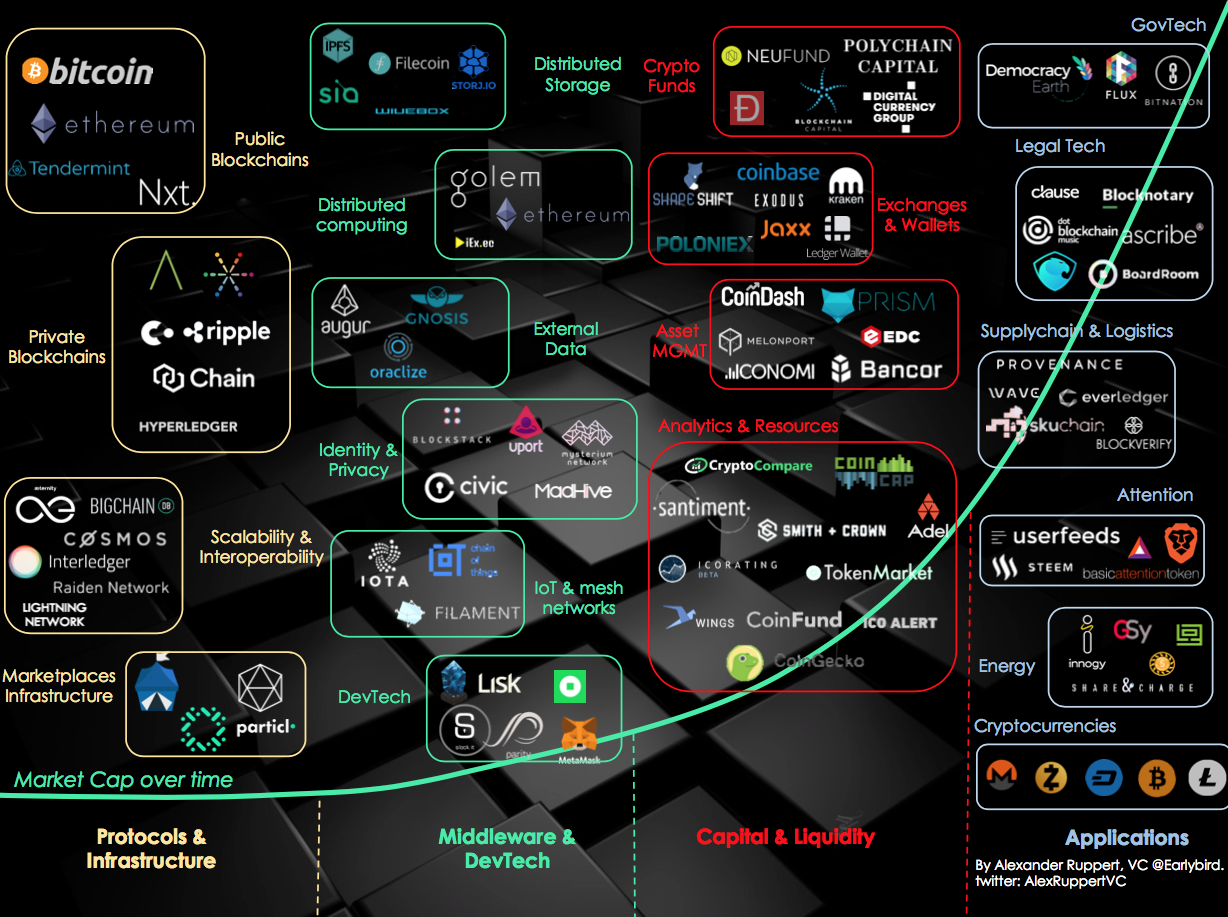

Mapping the crypto universe (left to right & top to bottom — medium accounts): ethereum, Ripple, Hyperledger Project, æternity, BigchainDB, OpenBazaar, Sia Tech, Storj, Golem Project, Augur, Gnosis, Oraclize, Blockstack Inc, The uPort Project, Filament, Lisk, Token, slock.it, Neufund, Blockchain Capital, ShapeShift.io, Coinbase, Ledger, CoinDash.io, Melon Project, The Bancor Protocol, ICONOMI, Smith and Crown, CoinFund, ICO Alert, Clause, Block Notary, ascribe, Provenance, Basic Attention Token.

Some hypothesis or how to read the map

The map reflects some of the crypto community’s and my own assumptions. It’s not comprehensive, I tried to focus on significant, abstractable trends only.

General

The waves of innovation flow from “left to right” — starting with platforms and protocols followed by middleware, new financing methods and finally decentralized applications built on top of all that. The total market cap follows this path.

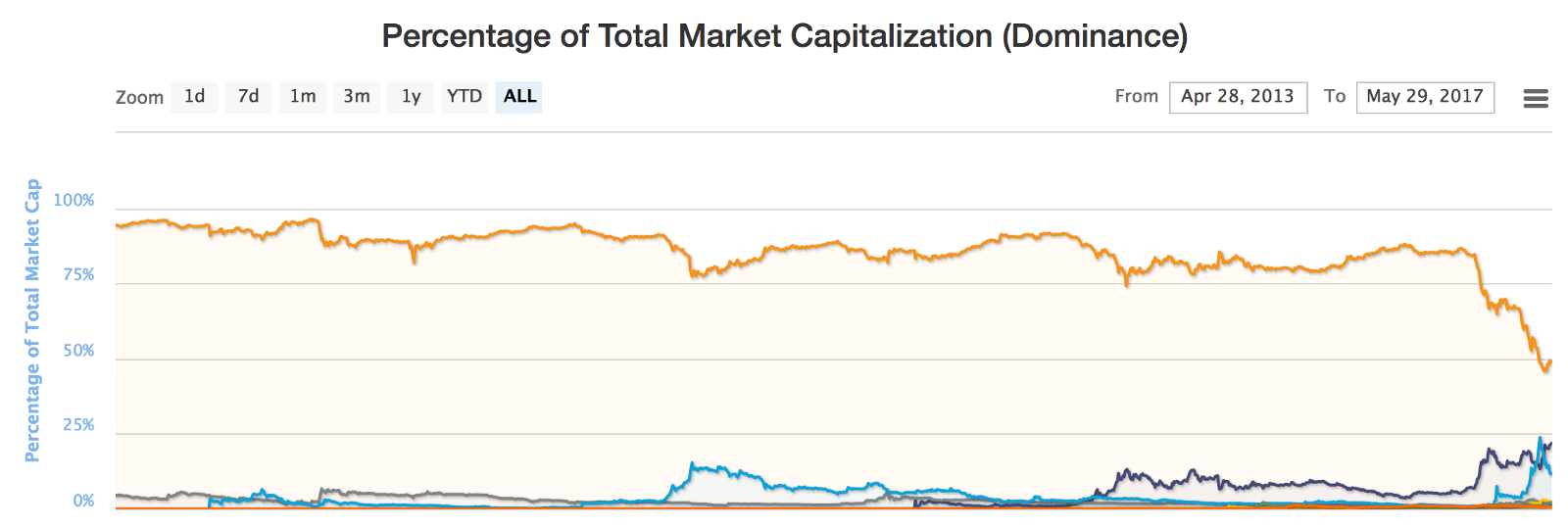

As of today most of the value in terms of market cap is created on the protocol layer (“fat protocols”) — about 70% of the market cap relate to Bitcoin and Ethereum ($51 bn of $71bn on May 29th 2017). One could also classify Bitcoin as an application though but it’s share of total market cap will significantly decrease over time. The more applications are built on top of the underlying systems and the more users become part of the networks, the more the underlying token gains in value.

source: http://coinmarketcap.com/charts/

Value is created on token level rather than on equity level, therefore opposing everything we experienced in conventional software businesses. Tokens represent an atomic unit of a company’s business model. Some are sold to finance the project but their main purpose is to monetize products and services in the long run. Tokens don’t make sense for any business model and need to fit into the company’s landscape of services to be useful.

Due to the strong influence of speculators and traders most parts of a crypto token’s value are based on speculation. A more objective approach of valuing a token would be to define its “utility value” by analyzing real life KPIs such as the activity of developer communities surrounding the project (github repos, contributors, quality of code), number of nodes and miners running the network, number of network transactions etc. over time.

Before launching end user facing, decentralized applications (Dapps), the underlying infrastructure needs to mature. Even on protocol layer we are still facing challenges around transaction costs and overall scalability of bitcoin or consensus mechanisms of Ethereum.

Middleware

On top of those protocols true Dapps will require decentralized middleware. Sia Tech, Storj, IPFS / filecoin, Maidsafe and Minebox are pursuing the vision of distributed storage. The data to be stored gets fragmented into hundreds of pieces, encrypted (hashed) and randomly spread throughout the network, stored with multi region redundancy. The pieces are moved through the network autonomously when nodes (computers within the network) are switched off — only the user has the credentials to restore it by using private keys only she holds. Think of AirBnB for storage capacities but instead of paying in $ you pay in tokens automatically when using the service. No backdoors, no infiltration by law enforcement agencies, no server crashes, unhackable.

Distributed computing (Golem Project, ethereum), self sovereign identity and privacy (The uPort Project, Civic, Mysterium, Blockstack Inc), decentralized domain name services, external data providers (Augur, Gnosis, Oraclize, æternity), Developer frameworks (Lisk, slock.it), Dapp Browsers (Token, Parity, Metamask) and crypto payments are further elements needed to run truly decentralized applications. Setting up the middleware could take another 5 years I expect.

Capital & Liquidity

The fundamentally different value creation allows for new kinds of venture financing in form of ICOs attracting developers, technologists, early adopters and mainstream investors in that order. Besides distributing the tokens globally among early adopters and ambassadors who might use it for paying the company’s services, tokens are much more liquid than conventional equity and can be traded on secondary markets in form of crypto exchange platforms such as our portfolio ShapeShift.io or Poloniex. The downsides are a lack of information and the tendency of huge whales outperforming the “small fish” and thereby again centralizing the whole movement, what happened to the BAT ICO lately:

https://etherscan.io/token/tokenholderchart/BAT (as of May 31st 2017)

The new financing mechanisms democratizing venture financing to a certain degree will trigger the explosive growth of tokenized networks by fueling the network ownership effect — an unprecedented growth mechanic, kind of a network effect on steroids. Imagine you get an incentive for making other people use a service you love. The speed of crypto innovation will outperform everything we have experienced over the past two decades.

Applications

Legal and GovTech will face significant change once programmable money matures. Contracts won’t need to be enforced by expensive and slow judges drowning in piles of paper but by code. In case specified conditions in smart contracts are met, actions — for example payments — are triggered automatically. Clause is working on very interesting solutions. Running distributed companies is an upcoming challenge Aragon and BoardRoom DApp address. Distributed voting systems and everything around liquid democracy are also potential use cases we will see in the future — bitnation-guides and Flux are leading this path.

Expensive non-value-adding middlemen and intransparent value chains are the reality in logistics and supply chain but blockchain will disintermediate. Wave, BlockVerify and Everledger are some of the pioneers in their respective fields to upgrade logistics and supply chain transparency.

We might see a paradigm shift from the “data economy” towards an “attention economy”. As soon as the infrastructure for self sovereign data ownership is in place and users get back the control over their data. Sovereignty will come at a price though. Basic Attention Token demonstrates how this could happen by incentivizing users who pay attention to ads with BAT tokens. Steemit incentivize content creators with their token Steem — think of being payed by the network for writing high quality stuff on reddit, medium or facebook. Userfeeds is building a new content ranking system making economic incentives behind content publishing and sharing visible — think of google with a transparent ranking algorithm fighting fake news and corruption.

As well as attention, logistics and law the energy sector operates in a very centralized manner by preventing people from trading electricity in peer to peer networks.

Payments are revolutionized by crypto currencies which have the main purpose to be used as digital cash — Bitcoin, Monero, Dash, Litecoin or ZCash are some of the most reputable coins. Instant settlement, no transaction fees, privacy and no governmentally controlled money supply are the killer features.

Mainstream adoption is still pretty far ahead, maybe 5 years or more. People don’t care whether or not software is built on blockchain technologies, what counts is utility and price. The big steps are made when large incumbent players integrate blockchain technologies. The messaging app KIK just launched its own token in order to incentivize developers building services on top of their ecosystem. Hopefully, Medium Staff and other media companies got inspired by Fred Wilson’s piece on why “Online publishing should look at Steem, not Spotify for inspiration”. Basic Attention Token now came up with a more generalist approach to this problem. Blockchain might also eat the marketplace stack. The question is whether the existing players (Uber, AirBnB, eBay) integrate the technology into their products or if they get attacked by some new kids on the “block”. Either way could lead to mainstream adoption.

Liked this piece?

-------------------------------------------------------------

>> Follow me on twitter for more crypto stuff.

>> Join our crypto trading & investing tribe in Berlin.

BlockchainBitcoinCryptocurrencyDecentralized WebOpen Source

Show your support

Clapping shows how much you appreciated Alexander Lange’s story.

940

32

Follow

|