OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Economics ... Taxation |

|

Burgess COMMENTARY |

|

ECONOMY ... Here’s How Much Bernie Sanders Would Soak The Rich

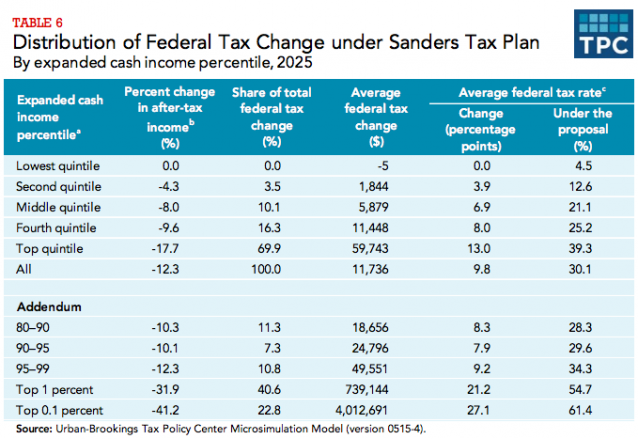

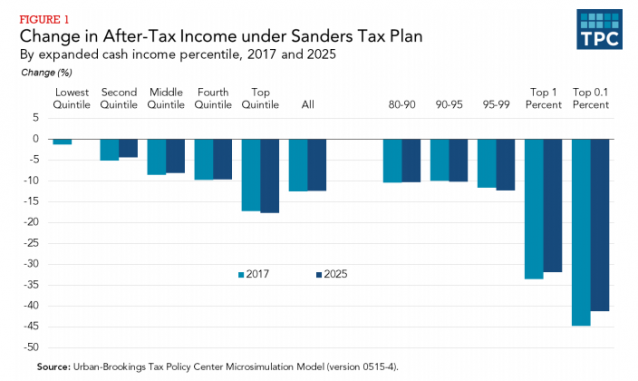

Democratic presidential candidate Bernie Sanders has premised the core of his campaign on a promise to raise taxes on the rich and corporations in order to pay for big expansions of programs for everyone else. Now the numbers are in to show exactly what that would look like. According to a new analysis from the Tax Policy Center, Sanders’ plan would raise $15.3 trillion over the next decade, mostly by hiking taxes on the wealthy. “The proposal would raise taxes at every income level, but high-income taxpayers would face the biggest increases, both in dollar amount and as a percentage of income,” it notes. Over a decade, everyone but the poorest fifth of Americans would owe more in taxes. But the burden would land mostly on the richest. About 70 percent of the increase in taxes would fall on the wealthiest fifth of the country; the top 1 percent of the richest would owe about $739,000 more, while the 0.1 percent, the very top of the income scale, would owe $4 million more.

The middle class doesn’t escape a tax hike, however. The middle fifth of the country would shoulder about 10 percent of the burden, owing almost $6,000 more over a decade. The number of low-income households that currently pay no income taxes because they make so little would also decrease after his plan would first go into affect, dropping by 8 million or about 4 percent.

Sanders would implement a number of changes to the tax code to get to those results. He would add a series of tax surcharges on households that make more than $200,000, raising the top marginal tax rate to 52 percent on income above $10 million. That would return the top tax rate to about where it was under President Reagan, who reduced it from 70 percent in 1981 to 50 percent in 1982. It hasn’t been increased back up to that level since, although growth has historically been stronger under higher rates. He has promised to implement new programs and institute new taxes to pay for them, which show up in the analysis. The higher income taxes would be combined with a new 6.2 percent payroll tax paid by employers to finance his single payer health care plan. A new 0.2 percent payroll tax paid by both employers and employees would finance a paid family leave program. He would levy a financial transaction tax that would be used to make college tuition free. And he would lift the Social Security tax exemption on income above $250,000 — currently those who earn money above that level don’t have to pay any of it into Social Security — to extend and expand benefits. Sanders would also tax capital gains and carried interest, money made through investing, at the same rate as ordinary income made through a salary. He would also lower the threshold for who pays the estate tax on large inheritances. All of his reforms would raise a huge amount of revenue for the federal government. The $15.3 trillion the Tax Policy Center estimates would come in over the first decade represents 6.4 percent of GDP, and it also estimated he would bring in another $25.1 trillion the decade after. Increases on the rich would account for about a quarter of the new revenue. Most of the new money would be put toward Sanders’ plans to create and expand federal programs. The revenue Sanders would raise is far higher than what rival Hillary Clinton would bring in. Her tax plans would raise $1.1 trillion over the first decade and $2.1 trillion over the next, according to an earlier analysis by the Tax Policy Center. Her plan would similarly put the heaviest burden on the wealthiest, drawing 80 percent of the tax increases from the 1 percent and less than 2 percent from the bottom three-fifths of the country. But someone in the 1 percent would owe about $120,000 more over a decade, compared to $739,000 under Sanders. She also mostly sticks to her promise not to raise taxes on income over $250,000, what she terms middle class. As much as their plans may differ, however, they are both at the polar opposite of what’s being proposed by Republican candidates. The Tax Policy Center has found that while plans from Donald Trump, Ted Cruz, and Marco Rubio all differ on details, they would actually lose trillions in revenue. And while many Americans would see tax breaks, by far the largest ones would be given to the richest of the rich. They also make promises to make their plans revenue neutral, which would necessitate enormous spending cuts in many government programs. |

|

BY BRYCE COVERT

MAR 7, 2016 10:12 AM |

| The text being discussed is available at http://thinkprogress.org/economy/2016/03/07/3757173/sanders-tax-analysis/ and |