|

|

TRUE VALUE METRICS

... for MANAGEMENT

GOOD DECISIONS ... MADE QUICKLY ... GETTING RESULTS

|

|

MONEY WEALTH / MONETIZED VALUE

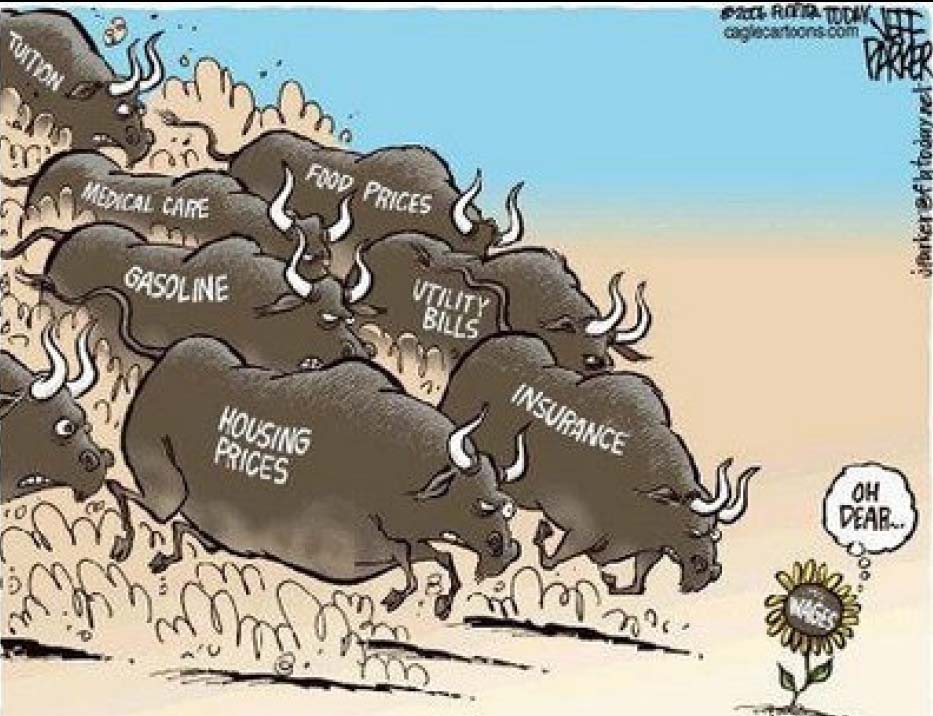

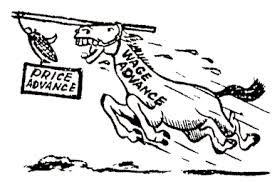

Money / Profit growth / GDP growth / Stock Prices / Cost push inflation / Wages chasing prices

|

HOW I CAME TO BE INTERESTED IN MANAGEMENT

I graduated from Cambridge in 1961 after reading engineering (Mechanical Sciences) and economics.

After a short spell in heavy engineering, I articled at Coopers and Lybrand in London and qualified as a Chartered Accountant in 1965.

Subsequently, I became interested in MANAGEMENT and the practice of improving corporate profit performance. This was at the time that computers were starting to be deployed in the corporate world and more and more data was being processed using EDP (electronic data processing). I saw data as a tool and not an end in itself and became very effective in improving performance not by getting more data but by using useful data in a timely fashion.

|

My introduction to heavy engineering

After graduating from Cambridge, I was recruited to be part of a 'Management Trainee Programme' at Davy-United Engineering and Foundry Company in Sheffield, England. We were a small group of young graduates who got the opportunity to work for several weeks in every department of the company as well as with some of the companies that were using Davy machiery. At the time, the company was one of the world's largest manufacturers of machinery for the iron and steel industry from blast furnaces to rolling mills. This was really heavy engineering. Davy United was the core company of the Davy-Ashmore Group and also the main unit of IISCON (the International Iron and Steel Consortium) that handled integrated steel mill construction projects internationally. WShen I was with Davy United, were were manufacturing for projects all over the world ... non only locally in England, Scotland and Wales, but in many countries around the world including Finland, Sweden, Autralia, South Africa, India and Mexico.

As part of my training I got to do shift work on a blast furnace and around coke overs, as well as in an open-hearth steel furnace shop. More than anything else I got to respect the men who were doing this work day after day, year after year. I also got to work on the development of automatic guage control, which was destined to improve the quality of steel sheet in a way that would be essential for efficient mass production or products like automobiles.

I also got to work (intern if you will) in the drawing office and the many different departments that did the paper-work. It was here that I started to realize how the factory and the paper-work had drifted apart with neither group having much idea of what was actually happening in the other part of the company. I started to understand that the way in which the white collar staff were pricing for contracts made absolutely no sense since the manufacturing cost assumptions they were making were were totally unrealistic. Though I did not realize it at the time ... I did not yet have the experience to be able to connect the dots ... this caused the company to fail several years later, but long after I had moved on to the next step in my career development.

|

Articles ... Learning to be a Chartered Accountant

I articled with Cooper Brothers & Co (CB&Co) ... specifically to Brian Maynard, a Managing Principal of the firm. Around this time CB&Co was in the process of merging with the American firm of Lybbrand, Ross Bros and Montgomery to form Coopers and Lybrand.

I was part of the first intake of articled clerks in the UK that were allowed to qualify in three years rather than five years because of our university degrees.

Because of my engineering studies and some field experience, I was given many interesting assignments. Early on, I got experience with the audit of Stewarts and Lloyds, one of the major integrated iron and steel companies in the UK at the time.

After I had gained some experience, I was assigned to do audit work on my own at one of the subsidiaries, a company called Bilston Iron and Steel. It turned out to be something of a challenge. Their single blast furnace 'went out' ... that is the combustion that normally keeps the process working and the iron hot and liquid, stopped and the molten iron froze. I found myself in the middle of a quite sophisticated argument about how this engineering catastrophe should be accounted for. Was the cost of this event going to be charged as 'maintenance' or would the work be capitalized because it really meant completely rebuilding the blast furnace. This was complicated by the fact that in this subsidiary, there as only one blast furnace, and essentially this meant the company was 'out of business' and could not be considered any more as a 'going concern'. I cannot remember how all of this was eventually resolved ... but it was the subject of much debate at the time.

Later on in my training, I worked on the audit of EMI (Electrical and Mechanical Industries), an iconic British company that had developed radar in the early days of WWII.

I think it was in 1963, I was part of an audit team that handled the audit of one of the very first computers used for accounting in the UK, maybe in the world. The computer was built by EMI ... a leading company in the UK in the electronics industry (the company largely responsible for the development of radar in the UK during WWII) and at that time, still on the cutting edge of technology as well as producing records for the Beetles. The EMI subsidiary EMI Records, started doing its accounting on a computer that EMI had made themselves. I was tasked with verifyng that the computer logic within this machine was actually doing the calculations in the right way and getting the right answer ... after all I was a graduate engineer! I was expected to validate the machine level logic, and ensure that it was impossible for rogue calculations to be inserted into the system without anyone knowing. This work was not made any easier by the fact that the year end was September 30th and the Beetles were releasing a new album on October 1st. At the year end we were told that there were several million albums in stock ... a few days later there were none. They had all been shipped! The problem was that the inventory accounting on the computer was updating the balances, but not keeping any audit trail of the actual transactions. We learn from mistakes. Sorting out this mess was quite a challenge.

Subsequently, Andrew Pinkney, the partner in charge of this audit drawing on the experience, wrote a book for the Institute of Chartered Accountants of England and Wales (ICAEW) called 'An Audit Approach to Computers'. Several years later, Brian Jenkins who was the 'senior' supervising the audit field work edited the book and it was republished. Brian Jenkins became a partner at C&L, as well as becoming President of the ICAEW and Lord Mayor of the City of London.

|

Using accountancy for business management

Every company of any size has a good accounting system, but well managed companies also use the accounting information in ways that help make better decisions. There is an enormous amount of useful data that flows through a company accounting system, and this information can be mobilized to help the decision making process.

Early in my career I worked for a Canadian consulting company that specialized in pulp and paper mill construction. At one time I had the job of 'field accountant' on one of the construction projects, and very early on in the construction my analysis of the financial data seemed to indicate that the contractors were spending a whole lot more money on one of the activities ... building the forms used to pour concrete ... than was provided for in the budget. I did some careful observations, did some analysis, and drew the conclusion that the contractor had far too many workers on the site. The next step was to convince my own boss, the head of our consulting team that my analysis was sound. The analysis of my work went on late into the evening. About 10pm my boss made a call to the Project Manager for the contractors to schedule a meeting for the next morning (Friday). Next morning my boss laid out the analysis arguing that the contractors were on track to have a project cost overrun of something like 100% and that this was unacceptable. The meeting did not take very long. On the following Monday morning, there were only 50% of the number of workers on the site. About 2 years later, the project was completed on time and just 5% over the original budget ... which was remarkable since the annual cost inflation rate at the time (the late 1960s) was in the low teens.

At another point in my career, I was part of a corporate management team and also serving as acting controller / CFO of one of the subsidiaries. The previous controller had been fired because for two years running there had been massive adjustments as a result of the audit that completely wiped out the subsidiary's profits for the year. It did not have any impact on the parent company consolidation because analysis of their monthly accounts suggested that there would be there year end adjustments. Of course the underlying problem was that the company was unprofitable and the local management had failed to do much about it. The top management of the subsidiary were convinced that they had reduced costs as far as was possible ... there were no more cleaners to let go! As an outsider, I saw the opportunity to reduce costs more substantially by letting go the President, and 5 out of 7 of the Vice Presidents. There were just 2 of us left at the senior level. The VP Sales added the job of VP in charge of Engineering, and besides being CFO I also became VP Manufacturing. A VP from the parent company made these changes on a Friday. I was asked what I would do first. I asked that my office would be relocated right into the middle of the factory ... decently appointed, but with glass windows all round. The office was built by the start of business on Monday. The parent company started a search for a new subsidiary President. In the meantime two of us had the job of making a success of this new lean management structure.

One of my first actions was to reschedule a daily production meeting that had happened daily at 10am to discuss the issues of yesterday. Starting Tuesday the meeting would be held at 8am to discuss the problems that were actually happening today. This made it possible to have the maintenance teams to be fixing problems by 9am. Without really doing very much, production increased significantly ... and in several weeks the factory was producing about 3 times what it had been before.

I consider the main purpose of data to be to help make better decisions. The company had been an early adopter of EDP (electronic data processing / computers) and cost accounting was part of the system. A foundry was part of the manufacturing complex, and more than 10,000 different castings were produced. The actual cost of making each of these different castings had been computed ... but actually what does one do with all of this data. It was a waste of time and effort. Worse, the engineering department was using the wrong thinking about how to reduce the production cost of these castings. Because the only metric that could be talked about was the foundry cost in terms of $/lb, the engineers were spending effort on making every casting lighter and lighter and at the same time weaker and weaker and more and more difficult to produce. We replaced the actual cost system with a standard cost system (together with variance analysis). Each of the processes within the foundry was costed ... how much did each of the processes actually cost ... and how did the costs change depending on the type of casting being produced. Each of the casting to be produced was assigned a standard cost based on the standard cost of each of the processes. Every month we could no compare the actual cost of running the foundry with the total of the standard cost of what had been produced. Very quickly it became very clear that complex light castings needed to be simplified in their design and increased in weight to reduce the true cost in manufacturing ... and then the sales teams were able to point at the improved strength of our products and there was a profit performance win-win.

In the early 1970s. the foundry industry was under pressure from both the massive increase in energy costs arising because of the OPEC oil cartel, new regulations regarding pollution and new regulations related to workplace safety and working conditions. For years the company had produced about 50% of its castings in its own foundry, and about 50% were bought from other foundries. Because of changes in the industry and difficulties in the supply chain when suppliers went out of business we decided to increase the throughput of our own foundry. By then we had a new President, who instructed me to get some consulting advice from a well known firm of foundry engineers. Yes sir ... and I did. The advice was expensive, and the capital expenditure program proposed was very high class and also very expensive. The proposed costs were far more than could be justified by our business situation, not to mention our corporate parent. I got a second opinion from a lower profile consulting firm that charged much less and proposed a project that was far lower cost than the first proposal. It still did not seem right. I started to walk around the foundry with all of the folk that had experience with the foundry, and especially with the maintenance manager ... a man who had been around the company for many years, but with no expensive formal education. Eventually he told me that there was a foundry not that far away that was being liquidated ... and that maybe we could buy some of their equipment and install it in our building to remove the various choke points that we knew about. In the end we spent about 10% on buying this equipment and installing it than if we had gone ahead with the initial consultant's recommendations, and probably got more capacity. This solved a critical production problem at very low cost, which was good. The fact that it was not the new President's idea was not so good!

|

IMPACT of the SMALL and MEDIUM SIZED ENTERPRISE (SME)

The purpose of economic activity is for people to improve and maintain

|

PROFIT

Profit is the all important measure of business performance. It is very well developed in the corporate organization, but is not enough.

In its most basic form it is simply the amount of Sales Revenue less the Costs incurred in doing everything to make those sales.

|

Outputs / Products ... Sales Revenues

The revenues are a function of the output and the price. To the buyer this price becomes a cost. For the seller, the profit is the amount the revenues exceed the costs. The impact of the product is a function of the early supply chains, the latest process, the use stage and the post use waste stage. For a full understanding of the product, the whole life cycle needs to be taken into consideration. Modern technology is enabling more information about the price of a product and what others think about the product, but the technology has not yet been applied to providing information about the impact the product is having on the complete enviro-socio-economic system.

|

Input Materials / Supply Chain ... Cost of Sales

All materials that are inputs into a production process have purchase price which becomes the cost of the input. But this is not just a single simple number, it is also a number that reflects the whole history of the supply chain.

In order for the material to get to the point of purchase it has already gone through a chain of processes all with a full range of elements of cost and impacts on everything. Each material going through a process has cost along these lines: materials, energy, labot payroll, labor benefits, taxes on labor, plant and equipment costs, advertising, financial costs, pro-good expenditures, government taxation, distributions to owners and retained profit. All of these are money costs to the business, but these costs also have impact on the people and place where the process is located.

|

PEOPLE / SOCIAL IMPACT

Organizations have a huge impact on the quality of life of people.

In conventional accounting people are not considered per se

There is a cost of payroll (salary and benefits) which is used in the accounting for costs and the calculation of profit.

And in conventional accountancy sales are associated with customers, but it is only the sales dimension that is accounted for.

|

Many dimensions of social impact / impact on human capital

Every worker in an organization should be paid a living wage.

Every worker should work in a safe environment.

Every worker should have the opportunity for advancement through training

The total payroll profile should not be significantly different from the profile of staff contribution to the organizational surplus

|

What impact do company processes have on people

What are the labor practices in the supply chain ?

|

What impact do company products have on customers (people)

Are there environmental health issues?

Are food products sage and nutritious?

Are products priced fairly?

|

What impact does the company have on the place

What impact does the place have on the company?

What impact does the place have on the workers of the company

|

PLANET / ENVIRONMENTAL IMPACT

Organizations also have a huge impact on the environment.

In conventional accounting environmental remediation of all types is considered only as a charge against profit

Environmental impact of all types is ignored ... it is outside the reporting envelope.

|

|

|

ELEMENTS OF THE P&L ACCOUNT

|

Go TOP

|

Products

PRODUCTS are what gets sold. In financial accounting 'price' and 'cost' of products are identified in the accounts. In addition to these there is also 'value'. For TrueValueMetrics PRODUCTS are also associated with IMPACTs ... the impacts on society (people), the impacts on nature (planet / environment) and the impacts on the economy (financial, physical and intangible). In order to have enhanced accounting that incorporates all of this, products have to be associated with a 'Standard Value Profile (SVP)'.

A set of benchmark SVPs is being developed for various classes of product. An individual specific product may also have an individualized SVP, which shows how a precific produce compares with the benchmark SVP.

|

Payroll

Payroll costs include the labor payroll, the labor benefits and maybe also taxes assessed on labor. These are all costs to the business (economic activity / process). However, these expenditures are also very important benefits to the individuals concerned and their families and the broader society in which they live. In economic analysis there is the impact of the 'multiplier' which associates the money earned in one activity with the money that subsequently flows through the economy in other activities. This has been computed recently in the Local Multiplier 3 (LM3) initiative for different locations in the UK, but is widely understood in economics. In the end it is payroll that funds aggregate demand. There is however, the perverse problem of more payroll is good for the broader economy but a lower payroll is good for the profit of the organization and the wealth of the owners. Productivity enables a lower payroll and more profit, but this sam productivity can end up destroying aggregate demand. In the short run the business does well. In the long term the business fails.

|

Energy

The financial and impact accounting for energy is similar to that of materials in that there is a supply chain, and the use of energy in a process results in both benefits for the process, but also impacts on the environment. The accounting logic is the same, but the computation of impact is based on a different set of standard impact values. There are standard impact values for each type of energy: electricity from hydro is different from electricity from coal, for example. Electricity from wind or solar has a different standard.

|

Materials

The financial and impact accounting for energy is similar to that of materials in that there is a supply chain, and the use of energy in a process results in both benefits for the process, but also impacts on the environment. The accounting logic is the same, but the computation of impact is based on a different set of standard impact values. There are standard impact values for each type of energy: electricity from hydro is different from electricity from coal, for example. Electricity from wind or solar has a different standard.

|

Plant and Equipment

An economic activity usually has some plant and equipment needed for efficient production. This plant and equipment has a capital cost which is accounting for through a charge for depreciation. The plant and equipment also needs maintenance which must be accounted for in systematic way. These costs have to be accounted for in cost of sales.

|

Process

The process transforms products that are inputs into the products that are outputs. The technology and efficiency of the process determines both money costs and environmental and social impacts.The cost and impact of process may be represented by standard costs for the various aspects of the process.

|

Philanthropy

Philanthropy or 'Pro-Good-Expenditures' have a cost that is a charge against the profit or surplus of the organization, but the activities that are funded with this money may have an important impact on the environment and on society depending on the activities. In some situations the cost of philantrhopy reduces the cost of taxation which increases surplus but reduces the impacts associated with the payment of taxes.

|

Taxation ... payments to Government

Taxation and other payments to government have a cost that reduces the profit or surplus available for distribition to investors, but the funds that flow into government are essential for the funding of government and the services that government has to provide in a modern society. The idea that less government is always better is wrong. The issue is the efficiency of government and the quality of the programs that are implemented.

|

Enabling Environment

The enviro-socio-economic system is very complex. Value adding economic activity is essential in order to support quality of life and standard of living, and for this activity to thrive there must be an efficient enabling environment. This means that there must be a system of laws and justice so that economic transactions can take place with a minimum of risk, that investments may be made, and so forth. In many places around the world setting up a business is a very difficult process that costs in both time and money, and in many places economic transactions are constrained in all sorts of ways. Business flows most easily with an enabling environment that has the least rules, but at the same time, too little of rules and regulation also may result in a range of abuses like inadequate workplace conditions, inappropriate exploitation of labor and pollution of the environment. Getting the balance right between ease of operation and good practice that has favorable impact for society and the environment is important and not easy.

|

|

|

|

|