|

|

ECONOMIC CAPITAL

FINANCIAL CAPITAL

FINANCIAL WEALTH IS CONSIDERED SUCCESS ... BUT ONLY PART OF THE STORY

|

Money / Profit growth / GDP growth / Stock Prices / GDP sucks

|

|

|

Conventional Money and Finance

|

GO TOP

|

FINANCIAL CAPITAL

Financial capital is man made. Financial capital is also the only capital that really does not exist per se, but is a function of the ownership and deployment of the other capitals. This is clear from a company balance sheet where the 'capital' of the company is represented by the (physical) assets of the company less the liabilities. Similarly an individual's wealth (financial capital) may be represented by ownership interest in various assets … house, car, personal property, stocks and bonds, insurance policies, etc … less liabilities. Financial capital presently is the dominant component of the perception of success.

|

ECONOMIC METRICS

GROSS DOMESTIC PRODUCT (GDP)

|

|

The GDP metric was introduced in the 1930s as a matter of some urgency better to understand the economic dynamic of the Great Depression. Both Kuznets and Keynes who used the metric pre-war wanted something better after the war. It never happened.

Years later, in 1968, Robert Kennedy addressed this matter, and again nothing happened.

More than 50 years later the GDP is still criticized but nothing changes!

|

|

Text from speach by Robert Kennedy on the absurdity of the GDP metrics

|

|

|

World GDP growth (red) has been rapid especially since 2000. US GDP growth (black) has been substantial, but slower than the world as a whole. A characteristic of GDP growth in the last 20 years has been the growth of production in low wage economies like China and the flatlining of wages in high income countries like the USA and much of Europe.

|

|

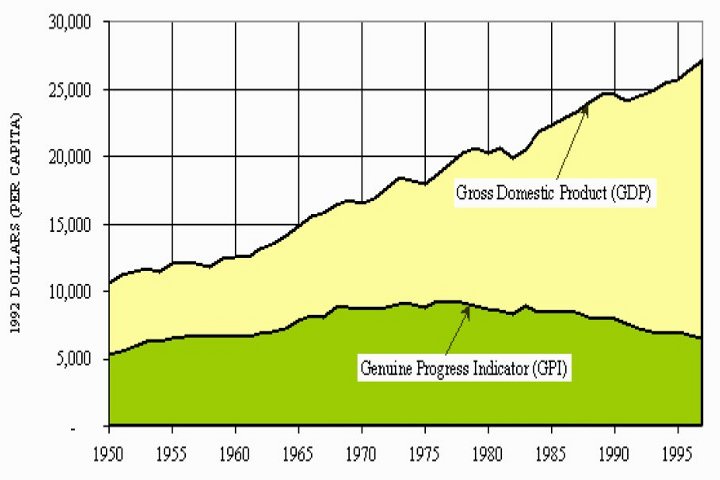

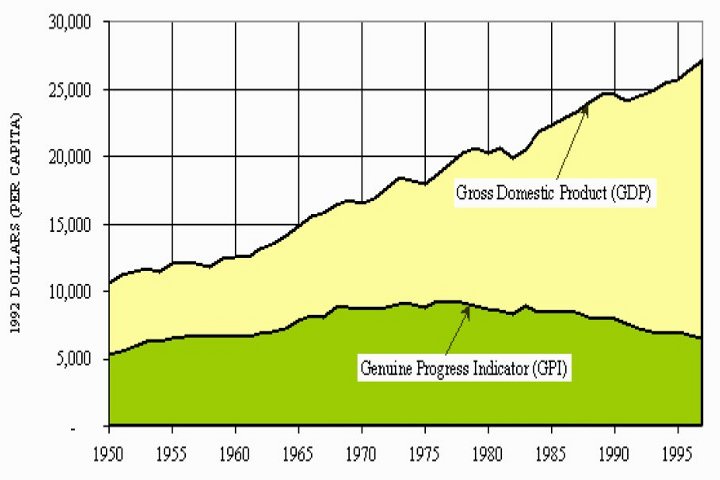

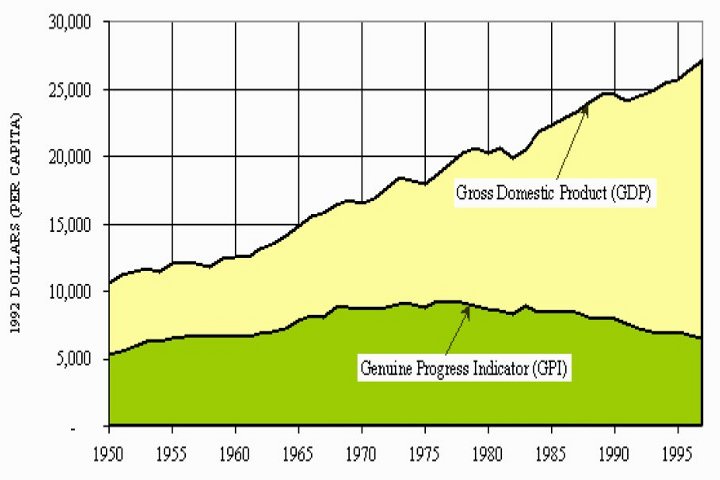

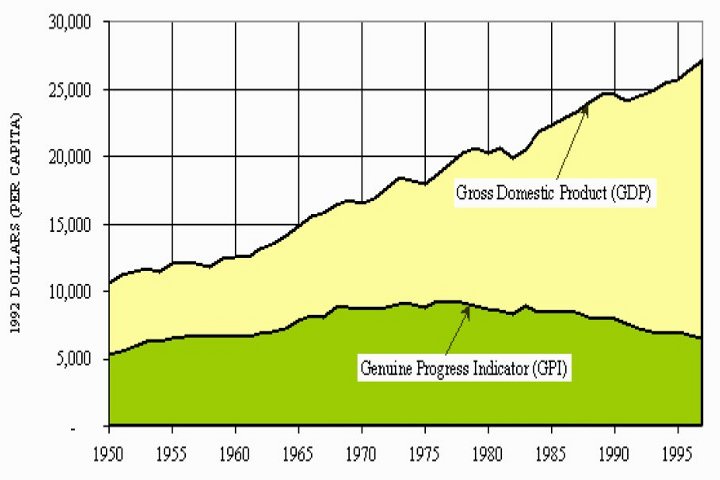

GDP is a measure that sends all the wrong signals about economic performance in any mature economy ... though there is a strong correlation between GDP and quality of life in poor developing economies. After the 1970s GDP has proved to be a bad proxy for quality of life in rich mature economies like the United States and Canada, many countries in Europe and Japan.

|

|

.

|

|

|

|

|

MONEY

MONEY is an inadequate metric ... it changes in size over time.

GDP

MEASURING THE PERFORMANCE OF THE NATIONAL ECONOMY

GDP measures consumption more than anything else. There is a weak correlation between quality of life and GDP ... better measures are possible.

MEASURING THE PERFORMANCE OF A CORPORATE ORGANIZATION

|

|

#10

|

ECONOMY / MONEY / LIQUIDITY

A VITAL LUBRICANT .. BUT NOT THE ENGINE

|

GO TOP

|

|

FINANCIAL CAPITAL

|

PHYSICAL CAPITAL

|

INTANGIBLE CAPITAL

|

INVESTMENT

|

BULLS

|

BUILDINGS

|

STEEL MFG.

|

SECURITY

|

CULTURE

|

|

THE FINANCIAL ECONOMY / MONEY and LIQUIDITY

|

MONEY

US$ has has massive value loss over time

|

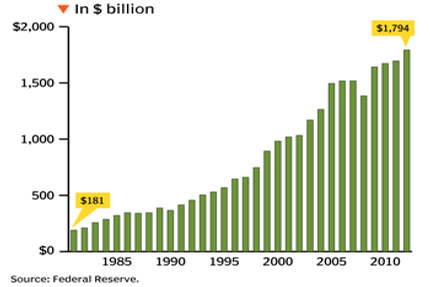

MONEY BASE

Monetary base has expanded since 2008

|

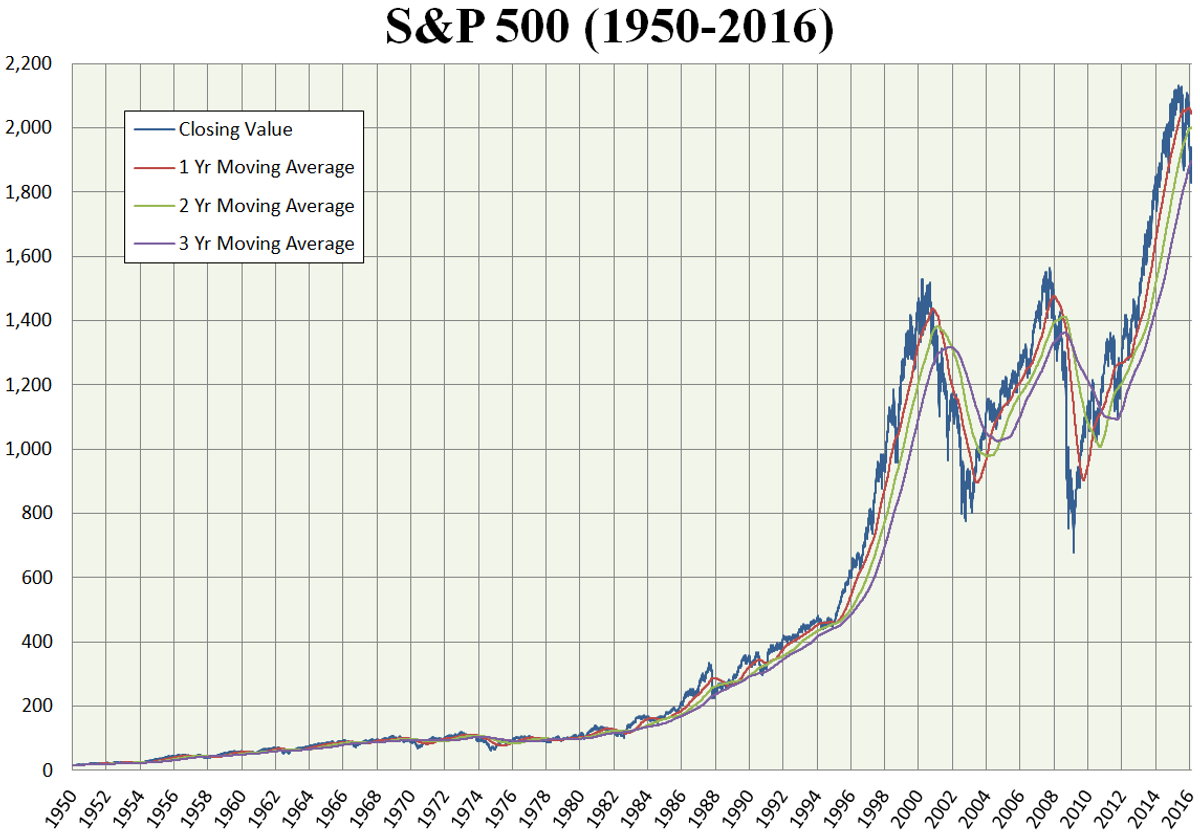

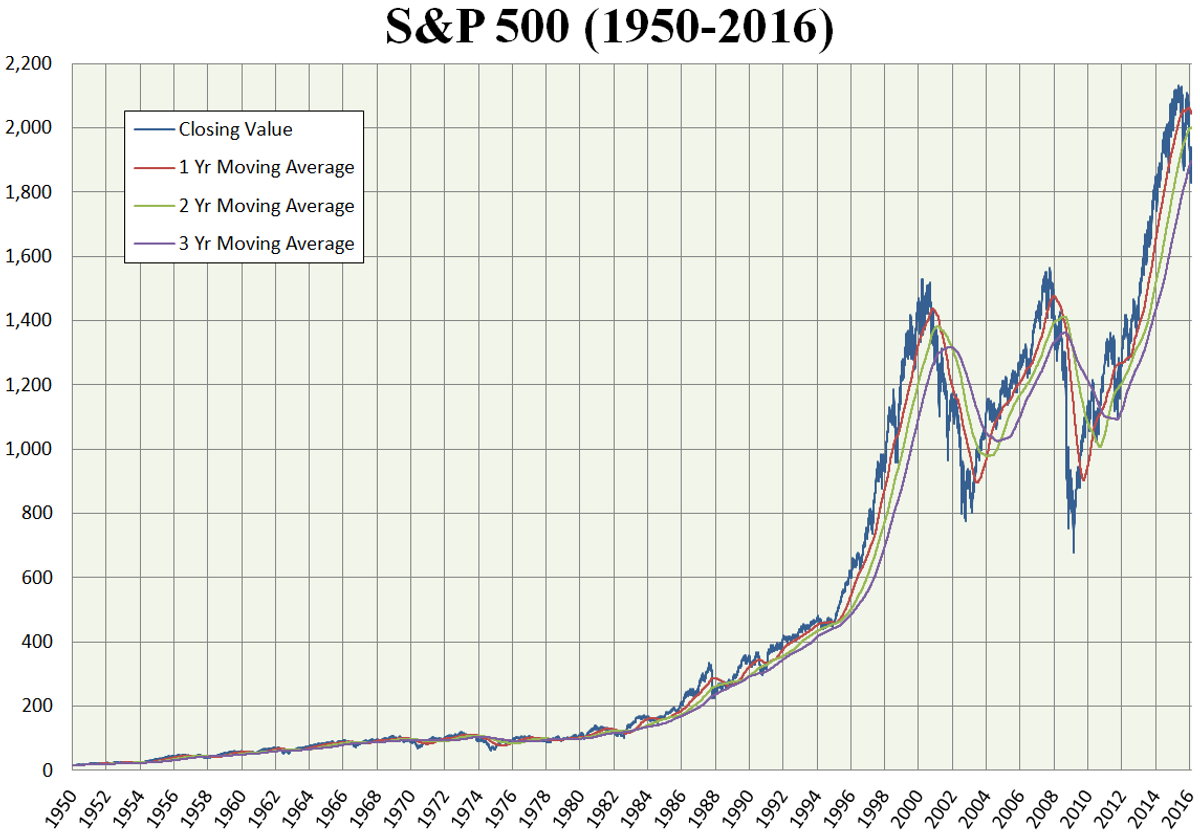

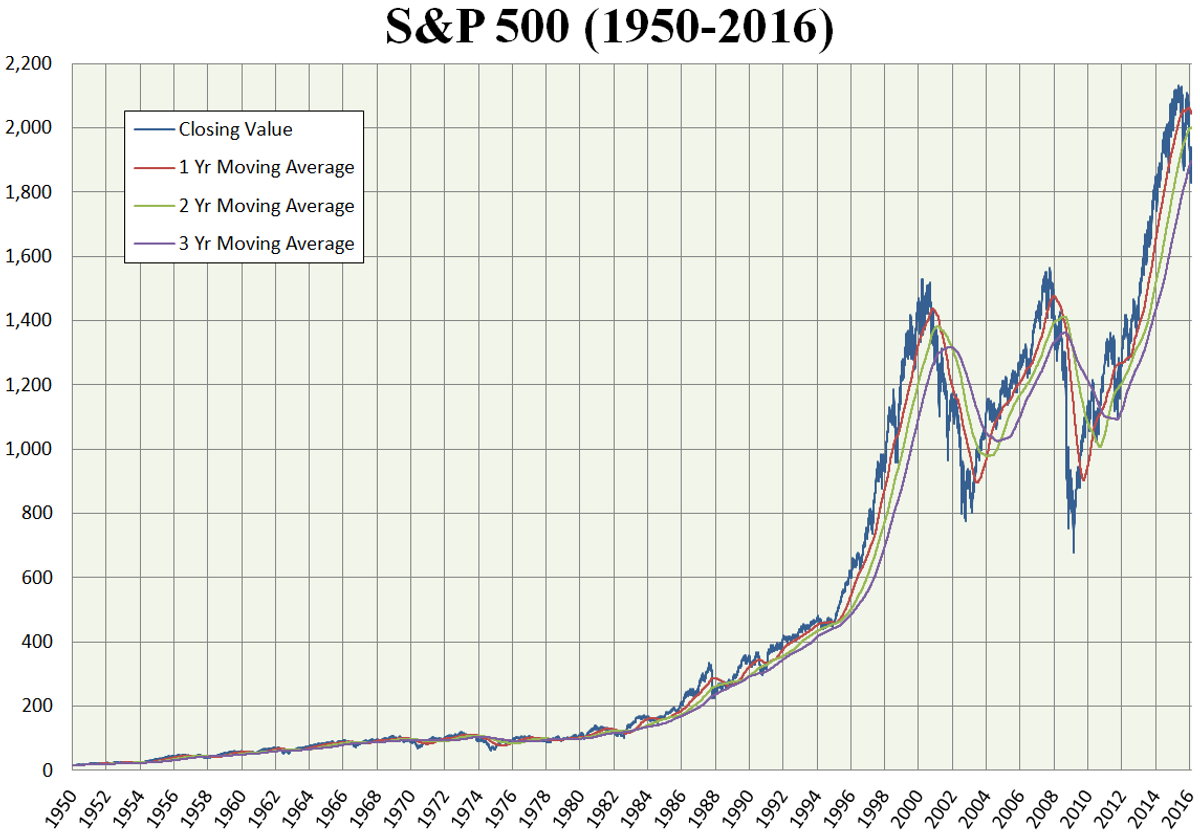

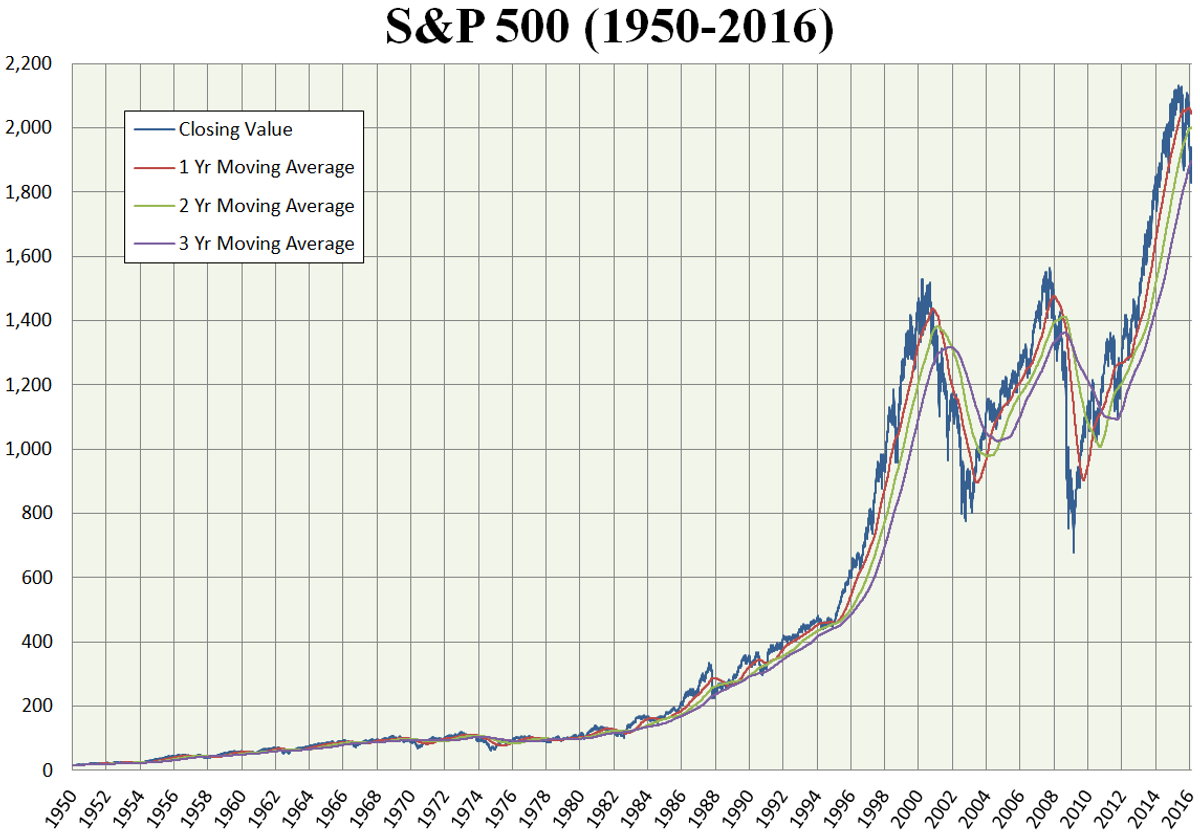

STOCKS UP

Stock market has been spectacular

|

MONEY DOWN

... but the buying power of the US$ is way down

|

WAGES FLAT

and wages flatlining while productivity grows.

|

GDP -v- GPI

While GDP is up, progress (GPI) is flat

|

|

CAPITAL MARKETS

|

|

FINANCIAL CAPITAL

|

PHYSICAL CAPITAL

|

INTANGIBLE CAPITAL

|

|

THE FINANCIAL ECONOMY

|

INVESTMENT

|

BULLS

A bull market has been good for investors

|

STOCKS UP

Stock market has been spectacular

|

MONEY DOWN

... but the buying power of the US$ is way down

|

WAGES FLAT

and wages flatlining while productivity grows.

|

GDP -v- GPI

While GDP is up, progress (GPI) is flat

|

|

Profits, Stock Prices and GDP measure success in the modern economy

|

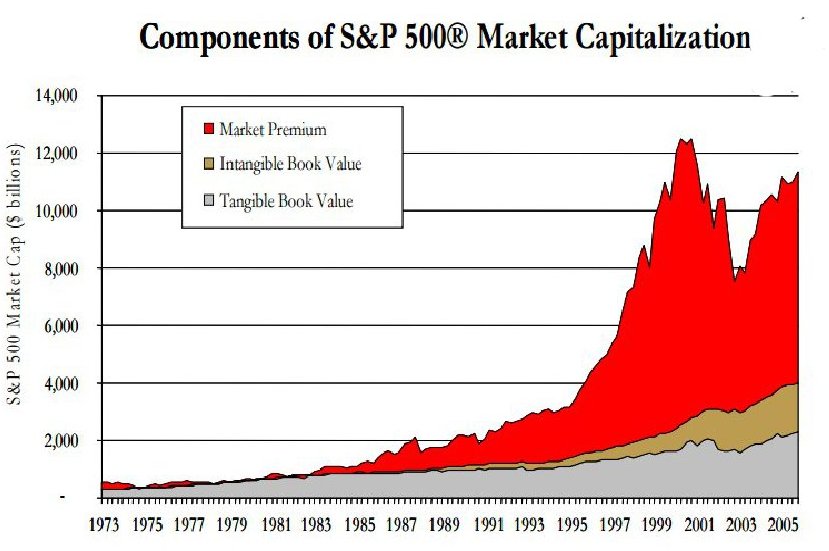

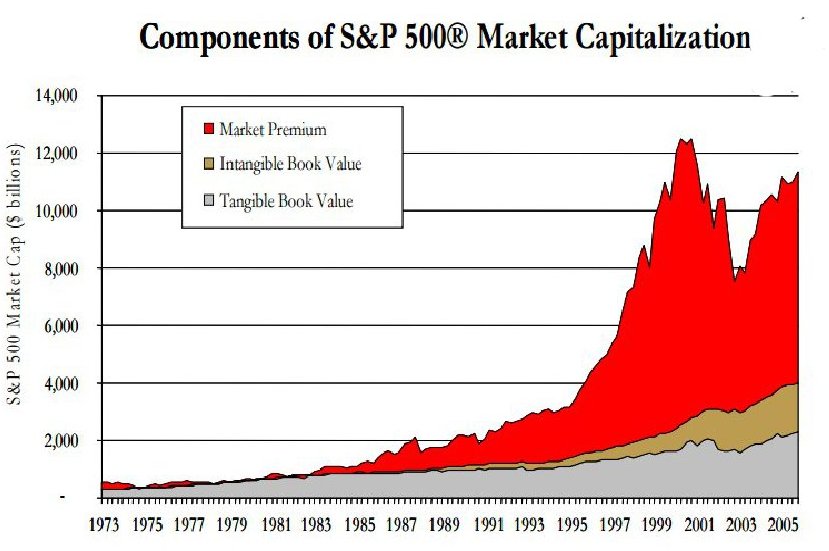

- The financial economy has grown robustly since the 1980s.

- Amazing innovation has been deployed mainly to improve profit performance.

- The huge expansion of financial wealth is excessivly concentrated.

- Concentration of economic power by both individuals and corporate organizations has come at the expense of everyone else.

- A lot of people are 'mad as hell' and don't intend to take it any more.

|

|

THE REAL (PHYSICAL) ECONOMY

|

BUILDINGS

|

INFRASTRUCTURE

|

STEEL MFG.

|

CEMENT MFG.

|

SHIPPING

|

RAILROADS

|

|

Buildings / Infrastructure / Industrial Processes / Transport

|

- Modern engineering and technology is deployed and exploited to improve profit performance.

- Rather little is is deployed to make society and the world a better place.

- The modern 'real' economy is pretty amazing, but not so much in the news (Western news, that is).

- Many of the more amazing things are going on in the Middle East (e.g. Dubai) and Far East (China).

|

|

THE INTANGIBLE ECONOMY

|

KNOWLEDGE

|

EDUCATION

|

GOVERNMENT

|

SECURITY

|

CULTURE

|

RELIGION

|

|

Many of these important things make life worth living

|

- These elements are very important, but metrics for their value are undeveloped.

- The intangible economy is a very important contributor to quality of life.

- Will remain at the margin as long as the dominant performance metric is mainly profit.

|

|

MONEY / LIQUIDITY

|

Stock market

|

Intangible value

|

Money supply

|

World GDP growth

|

US GDP growth

|

GDP v GPI

|

|

Without money / liquidity, the system stops working ... or never gets started

|

- The money system is very powerful, and difficult to understand.

- Some commonly held beliefs are wrong.

- It is unclear if any of the proposed better systems would be any better.

|

|

Economic and financial metrics going up ...

|

US GDP growth

|

World GDP growth

|

|

|

Stock market

|

Intangible value

|

|

|

Money supply

|

Balance sheet cash

|

|

|

|

... but social metrics have flatlined or worse for several decades ...

|

Value of $ down

|

Value of $ down

|

|

The buying power of money has declined dramatically over time ... likely because of a systemic flaw in how the money system works

|

GDP v GPI

|

Wages flat

|

|

|

|

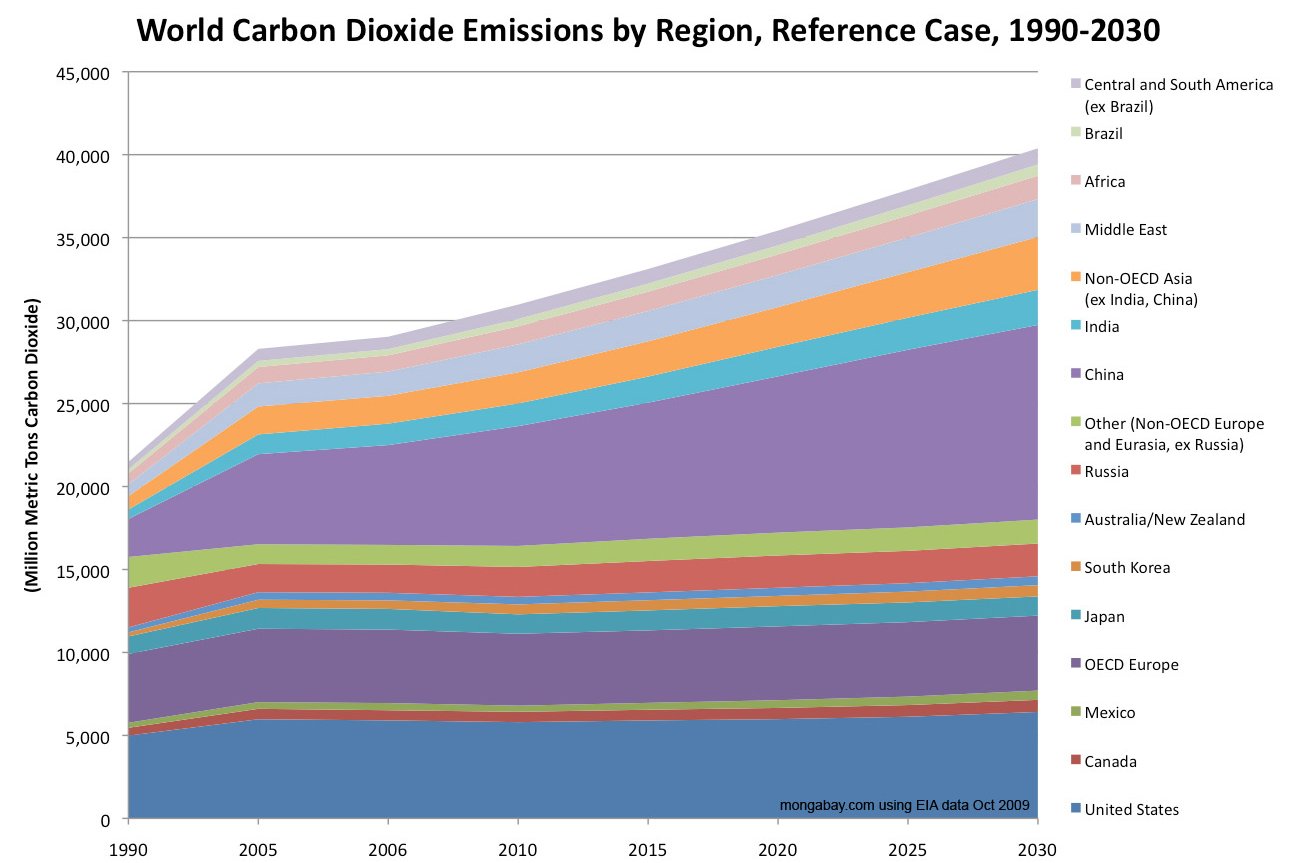

... and environmental trends are catastrophic

|

|

|

|

CO2 concentration

CO2 concentration

|

|

Temp v CO2

|

Sea level rise

|

CO2 emissions

|

|

Stacks of 50-subject one dollar note sheets at the U.S. Bureau of Engraving and Printing in Washington on April 14, 2015. (Andrew Harrer/Bloomberg)

|

Cut stacks of $100 bills make their way down the line at the Bureau of Engraving and Printing Western Currency Facility in Fort Worth, Texas. (AP Photo/LM Otero)

|

Since

|

|

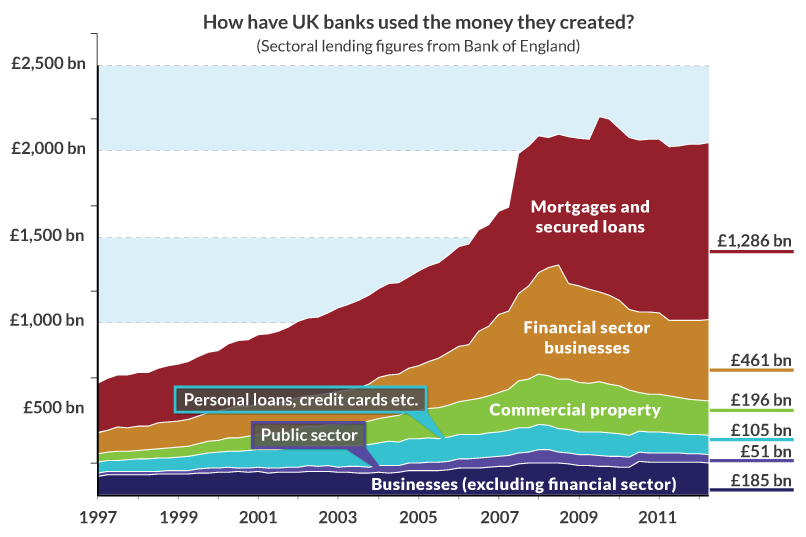

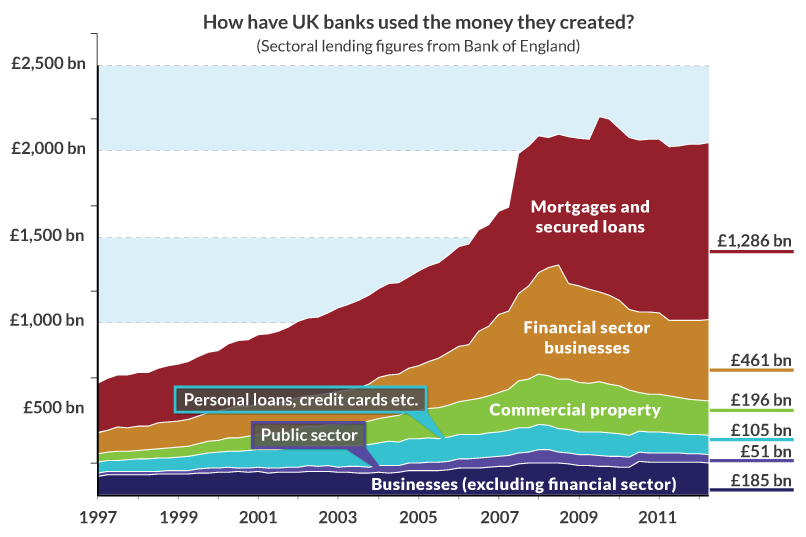

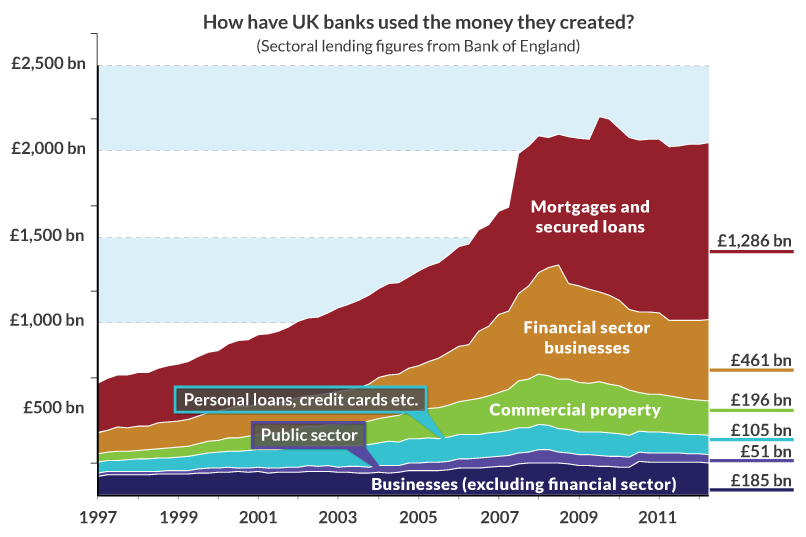

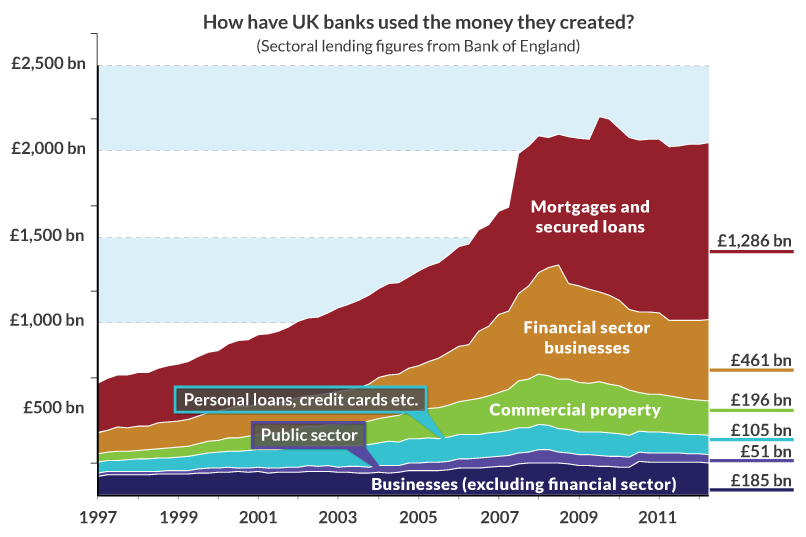

UK Bank Lending by Sector from 1997 to 2012

|

|

UK bank lending grew along with the size of the British economy from 1997 to around 2007, at which point there was a surge in lending to the financial and real estate sectors ... and a subsequent banking crisis as these loans proved unviable.

What is particularly concerning is that the lending to non-financial businesses ... what one might describe as the 'real economy' which produces the goods and services that we all need to live our lives, has flatlined for this period, as it has done for a very long time before this period.

|

|

More about Banking and Finance

|

Open L0700-SS-BF-BANKING-FINANCE

|

|

|

Crowdfunding

Some more detail about Crowdfunding

|

|

|

|

Crowdfunding

What WikiPedia says about Crowdfunding

'https://en.wikipedia.org/wiki/Crowdfunding'

|

Open Wikipedia page

|

|

|

Initial Coin Offering (ICO)

|

GO TOP

|

|

|

Initial Coin Offerings (ICOs)

Some more about ICOs

|

Open L0700-II-ICO

|

|

|

Initial Coin Offering

What WikiPedia says about ICOs

'https://en.wikipedia.org/wiki/Initial_coin_offering'

|

Open Wikipedia page

|

|

|

Initial Public Offering (IPO)

|

GO TOP

|

|

|

Initial Public Offerings (IPOs)

Some more about IPOs

|

|

|

|

Initial Public Offerings (IPOs)

What WikiPedia says about IPOs

'https://en.wikipedia.org/wiki/Initial_public_offering'

|

Open Wikipedia page

|

|

|

Private Currency

Some more about Private Currency

|

|

|

|

Private Currency

What WikiPedia says about Private Currency

'https://en.wikipedia.org/wiki/Private_currency'

|

Open Wikipedia page

|

Stock Exchanges

Some more about Stock Exchanges

|

|

Stock Exchanges

What WikiPedia says about Stock Exchanges

'https://en.wikipedia.org/wiki/Stock_exchange'

|

Open Wikipedia page

|

|

MONEY ... UNIT OF MEASURE ... UNIT OF ACCOUNT

|

|

|

|

|

BANKING AND FINANCIAL SECTOR SYSTEMS

Commercial Banks

Investment Banks

Central Banks

Development Banks

SWIFT

Banking regulation

|

|

|

|

|