|

|

ECONOMIC ISSUES

US PRODUCTIVITY AND WAGES

Peter Burgess ... October 2015

|

|

Cum. US Productivity -v- Wages

|

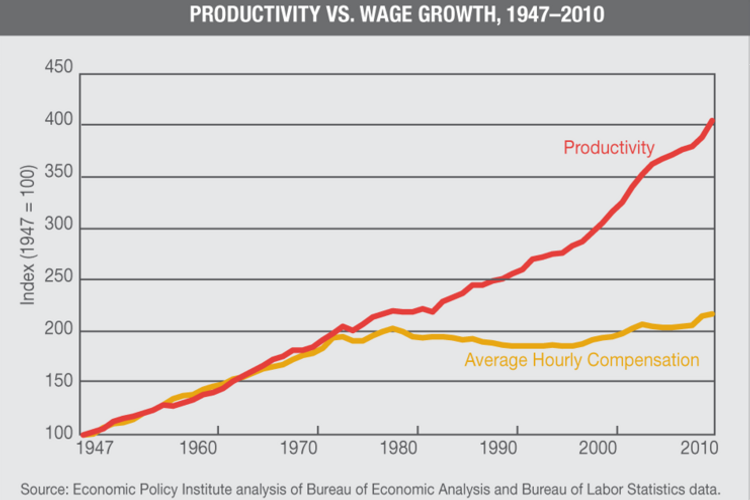

Productivity -v- Wage Growth

|

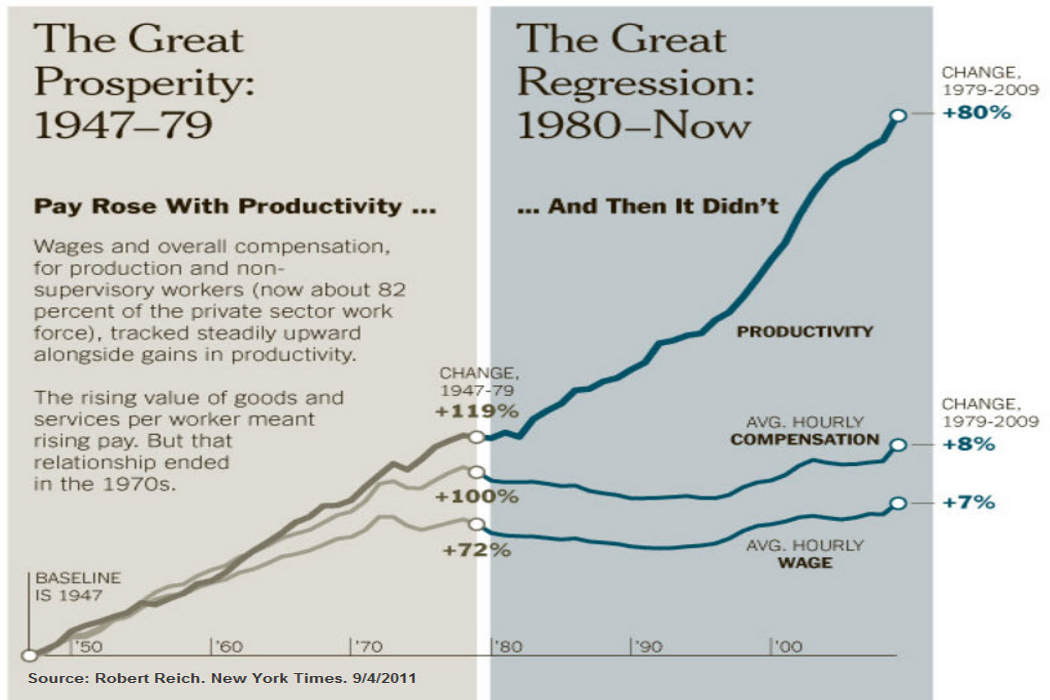

Productivity -v- Wage Growth

|

|

|

|

Why is it that US hourly compensation has flatlined for nearly 50 years?

There are many different versions of the graph above that have been included in a flood of reports about

economic performance. They are all pretty clear about the reality that wage earners have not shared

very much in the benefits of improved productivity during the period from the 1970s to the present,

while during the period from the end of the Second World War until the 1970s productivity and hourly

compensation improved together.

What changed and what to do about it?

My understanding of this history is that during the period from the end of the Second World War to the

1970s productivity improvement translated into more wages and more profits without any major

disruptions. During this period US companies had several significant advantages compared to the rest of

the world. Perhaps the most significant advantages were (1) that the US industrial infrastructure had not

been destroyed during the Second World War, (2) the country had accumulated substantial financial

resources available for investment as a result of high profits during the war years and (3) the country

had lower energy costs than anywhere else.

By the 1970s the first two advantages had substantially diminished and then the OPEC oil shock

removed the lower oil cost advantage and the USA economy lost its huge comparative advantage

relative to the rest of the industrial world.

At the time, I was surprised that there was rather lukewarm push back against the legitimacy of the

OPEC cartel, but then I realized that there were important players that were going to get critical benefits

from the OPEC action, notably the countries that were developing North Sea oil and gas that needed

higher prices to be profitable and, of course, the multinational companies in the oil industry itself that

were going to be a lot more profitable as a result of the global higher price regime.

The oil industry as a whole got advantage from the monopoly pricing of the OPEC cartel, whether or not

they were in an OPEC country, and it was every other sector that had to pay. The big integrated oil

companies were able to profit mightily without changing in any way their manner of operating. There

was a lot more profit for the companies and the investors, but not much more wages for workers.

The energy price cost push inflation of the 1970's oil shock pushed profits down for every industry

except the oil industry, and this set off round after round of price increases and outofcontrol inflation

which could not be controlled at all by monetary policy. This created all sorts of wage pressures … to the

upside for workers because of cost of living, and to the downside as companies tried to maintain profits.

Nixon era price controls did not help ... and other Nixon initiatives would eventually help change the

landscape for the US worker like establishing relations with China, the OSHA initiative, and setting up the

Environmental Protection Agency (EPA).

The 1970s oil shock also launched a new era for global banking, driven by all sorts of banking creativity

in both London and New York as huge amounts of new liquidity in the oil producing countries needed

world scale banking services and financial advice. While OPEC profits were accounted for in the national

accounts and wealth funds of various oil producing countries, the resulting 'petrodollars' were actually

banked in London and New York. Brilliant … and another part of the global economy that now started to

benefit from the OPEC induced higher energy costs.

In the early 1980s, a hopeful Republic President Reagan set the stage for less inflation through low wage

growth by the very simplistic but easily understood ideology of the free market economy and challenges

to the status of workers, collective bargaining and unions. While less regulation made Reagan popular it

also enabled the idea of 'greed is good' in the financial sector and a freewheeling culture that ended up

with the infamous Savings and Loan Crisis.

Not well remembered, but by the end of the 1980s it was widely thought that the future would belong to

the Japanese and not the Americans. President Bush 41 got elected and benefited a little from a peace

dividend as the Soviet Union imploded but then lost his reelection bid as the US economy stagnated.

By the time the Clinton administration was in power, technology driven productivity improvement was in

high gear and enabling massive improvements in profit performance without requiring much in the way

of increased employment ... more productivity, more profits but not much more payroll. By this time

inflation was under control because of wage stagnation in the USA and a larger and larger amount of

product being sourced from low wage low regulation (workplace safety, environmental pollution, etc.)

countries. The Clinton administration aided in the decline of US wages relative to productivity and profits

with NAFTA and then much more freedom for the banking and finance sector by the repeal of the GlassSteagall act. Some of the underlying economic weakness of the USA and the industrialized countries was masked during the late 90s by the work required to avoid computer disruption arising from potential Y2K problems.

In the BushCheney administration after 9/11 there was unhealthy expenditure growth for the military, a

further deterioration of banking standards and practices and a standard of living supported by a massive

amount of creative credit that eventually morphed by the end of these Bush years into a full blown

global financial meltdown, business bankruptcies and massive job losses.

The Obama administration did a remarkably good job of mitigating the damage that had been done to

the global economy by the financial crisis. They set the stage for the financial sector to recover, though

it is not at all clear whether or not the underlying fundamental issues about the money, banking and

financial services industry have been resolved. Capital markets have recovered in the nearly 8 years

since Obama became President. The Obama team also made it possible for the US automobile industry

to survive and then recover in terms of profit performance and production ... though less so in terms of

employment and wages and pensions. Obama's successful interventions in the economy made a huge

difference and stopped a potentially devastating economic crisis. Unfortunately the economic and

political ideology of the right who has had control of Congress and therefore the Federal budget, made it

impossible to implement policy options that would have made the economy better for US workers. There

has been numerical growth in employment, but little or no growth in the wages being paid to workers.

Blaming Obama alone for the relatively weak recovery of the US economy since 2008 is just plain wrong

… a big part of the blame belongs to a seriously wrong thinking Congress. Bottom line is that the

systemic catastrophic banking meltdown of 2007/8 was not really fixed, but merely its impacts

mitigated by some interesting and creative innovations.

Nevertheless corporate profits have reached record levels as well as stock market valuations. Virtually

none of this wealth reaches those that work for a living and there is inadequate taxation flowing into

government relative to profits and too many entities of government worldwide are starved of the funds

they need to do what they are mandated to do.

It is a pity that few people looking at the data and talking about economics seem to understand that a

big part of the poverty of working families has come about by the transfer of their wealth to the banking

and financial services industry, to educational establishments and to the health care industry from those

in relatively poor paying jobs.

There was a time when banking had a community focus, but that has disappeared in the last fifty years

and been replaced by a lot of 'high finance' that few people understand. One characteristic of modern

banking and finance is that rather little real wealth is created, yet the banks are able to accumulate

wealth by facilitating its transfer to this segment of the economy. Few people understand the dynamic of

money in the banking and finance industry and there is little talk about the huge increase in the amount

of money in the global economy that was 'created' in order to keep the modern system afloat following

the financial crisis. There is no 'value' backing this increase … but this does not seem to bother anyone in

banking and finance. This should not come as a surprise because stock market valuations also are

significantly higher than the underlying real value of the companies they represent.

Over the past 40 plus years young people have been encouraged to get more education. This has been

good for universities that have increased in size and sophistication. It is not at all clear that this has

been all good. Many students graduate with an excessive amount of debt while at the same time having

less opportunity now than they would have had in the past. Universities and policy makers do not seem

to be able to grasp the fact that productivity (in the interest of maximizing profit) is going to reduce the

need for workers in ways that have never been seem before.

In the health care sector, as in other sectors, it is important to differentiate between cost, price and

value. The value of good health is a universal reality. Thanks to amazing modern medical knowledge

many healthcare interventions are now very low cost, but the system in the United States especially

makes the price of healthcare very high … and profits high. Over the past fifty years the profit centric US

healthcare industry has moved family wealth from families facing health crises to the institutions of

healthcare every time there is a health event. Around the world, wealthy people can access good

healthcare, but those who are poor, access to good healthcare is still totally inadequate.

While incomes have stayed much the same, these wealth transfers have become bigger and bigger year

after year after year.

Family balance sheets of middle class Americans have deteriorated catastrophically over the past few

decades. Several decades ago this was not such a big deal, but now most once middle class working

families are 'under water' while the owner class is doing very well.

Over the past 80 years owners (of companies and physical assets) have seen the money value of their

assets increase significantly. There have been periodic bubbles that have disrupted this important long

term trend ... as in the recent housing bubble that helped precipitate the recent financial crisis, and a

variety of financial manipulations to make profit without much underlying reality. The sad thing is that in

the aggregate, rich people lost little in the bubbles, while poor people lost a lot! In fact, these bubbles

enabled the vulture investment community to profit mightily and make the situation of the economically

challenged even worse.

One of the issues that does not get described well in the popular mainstream media is the difference

between the state of government finance, and the state of national finance. There has been a multitrillion growth in the amount of US dollars held in China, but these trillions of dollars are in China not because of the behavior of the US government but because of the behavior of the US private sector. The

cost reducing profit increasing outsourcing that has been practiced by the US private sector for decades

has sent dollars to China as part of the widely used business strategy of outsourcing to reduce costs and

increase profits.

Worse, the private sector is also actively keeping cash balances outside the United States in order to

minimize taxation … good for investors, but not good for the country and the society at large.

The problem of US government expenditures exceeding government revenues is an entirely different

issue. It cannot be solved by political grandstanding but must be solved by much improved decision

making and the management of resources. There is a lot of government spending that is inefficient and

ineffective where better management will make a difference. Some of this is a result of 'pork barrel'

politics and some is simply poor decision making and operational inefficiency. At the same time, there is

not enough government revenue. The fact of near bankruptcy of almost every government (public

sector) entity in the United States and indeed around the world, is appalling, especially when taxation is

quite low by historic standards and expenditures on public infrastructure and services is completely

inadequate.

So … how can this be changed for the better.

It is sometimes said that it is money that makes the world go round. Money is both a medium of

exchange and a store of value, and there is a huge infrastructure to enable money to function. The

dominant metrics for performance are based on money. As long as the dominant metrics for decision

making are corporate profits, stock market prices, GDP growth (thought of as good) and Government

debt (thought of as bad), not to mention political polling, it should not be surprising that we have social,

environmental and economic dysfunction both on a global scale and in everyone's back yard!

People like Keynes and Kuznets in the 1930s worked on major improvements in the way the

measurement of economic performance was done ... and then Richard Stone and others postwar ... but

it is only the GDP growth piece of these measurement systems that is much talked about ... and that is

dangerous.

With established measures for profit performance, innovators are able to raise funds for initiatives that

are going to make big profits ... and this explains to some extent the growth of profit in an otherwise

rather dysfunctional economy. Funding initiatives that are only going to do good (including infrastructure,

famine relief, etc. etc ) is near impossible and will remain so as long as rigorous system of metrics for

their performance does not exist. While money profit performance is measured using accountancy, doing

good goes unmeasured and is only justified by 'stories' and not much else. There are better ways!

We don't have similar measures in respect of the value of people … what people contribute and what

people need in order to survive, and better, to have a decent quality of life. We don't have a way for the

value of a person to be moved in time, the way the value of money can be moved in time simply by

storing it in a bank!

Nor do we have measures for the value of mother nature … natural capital. Wealth (that is money

wealth) has been created not so much by innovation and enterprise but by exploiting natural resources

and labor and then dumping all sorts of waste into the environment polluting land, water and the air. This

dumping is now proving to have consequences and a huge cost that has never been accounted for.

We need a system and measures that will help us to understand cause and effect. Correlation is not

enough, especially in a world where acceleration of technological change has become an important

constant.

Restructuring the way the economy works is needed, and the amount of change required is significant.

But the system is very complex and big simple long term initiatives are as likely to be wrong as right.

Rather change must be based on everyone being set up to have a better life based on their own

decisions and at the same time these decisions aggregating into a better situation for other people, for

then for everyone in the place and eventually everyone in the world.

Better metrics need to have an architecture that enables an understanding of progress and performance

in everything that matters … not just profit, stock prices and GDP growth … not just the performance of

business but also the progress of people and the process of the place. There is need for a better quality

of life with the least depletion of natural resources and degradation of the environment.

The architecture of an effective data system must respect the idea of state and flow, something that is

incorporated in conventional double entry accounting, but conventional accounting needs to be expanded

so that the state of people and the state of natural systems and resources is brought into account. The

data architecture should be able be applied in a corporate setting, or for an individual, or family, or the

place. The architecture should help explain everything of importance in the supply chain of a product,

during its use and eventually in the post use waste chain. The system should work as well in a linear

economy as it does in a circular economy.

The system and the data architecture should work for big picture aggregation as well as for

disaggregated detail that is needed for the critical microdecisions that every individual makes every

day.

The system and the data architecture should help us to understand how we can all make decisions so

that there can be prosperity in terms of quality of life without economic growth … economic growth that

depletes natural resources and degrades the environment in ways that are increasingly an existential

threat to the future of us all.

Big data might be able to help, but it will be better to have a small amount of the right data, and

architected in a system that makes it possible for better decisions to be made by everyone, and

especially those most affected by the poor performance of the socioenviroeconomic system. This is

about data and feedback not simply about data.

The system should facilitate accountability and transparency so that good can be recognized and bad

things identified and penalized. We are already seeing the impact of modern technology in enabling

changes in the way information flows. No longer is information in the total control of intermediary

gatekeepers that regulate all data flows … and there can be both selfreporting from inside a company

out as well as social reporting of public perceptions. There is no reasons why technology should not

enable everyone to have meaningful information about every product that flows through their lives …

just a click away all the time everywhere!

All of this is very exciting. I was in the middle of the first wave of corporate computerization. At the time

most senior managers were very skeptical that the new fangled management information systems

would amount to anything, but in fact they have proved to be more important and powerful than

anything that was envisioned during the early stages of the first wave. To my mind what is now possible

is way more exciting than what we were starting to do fifty years ago.

Peter Drucker, the well known management guru, famously said that you can only manage what you

measure. I agree with that, but you had better be measuring all the right things.

Exciting times … huge opportunities.

|

|

|

|

|

|